Following release of new guidance by HM Revenue & Customs on 12 February 2024 in relation to the taxation of double cab pick ups, within the space of one week, the government has retracted this new guidance.

The changes to the guidance, which were due to come into force from 1 July 2024, came about as a result of the ruling in the 2020 Coca Cola Court of Appeal tax case. Had it not been revoked, the changes would have meant that all multipurpose vehicles, including double cab pick ups with a payload over 1 tonne, would have been treated as cars for benefit in kind and capital allowance purposes rather than as commercial vehicles.

Although businesses would have suffered in the rate at which they would have obtained tax relief on acquiring such vehicles, as well as in the amount of National Insurance due on the provision of the vehicles as benefits, it is employees who would have been hit hardest.

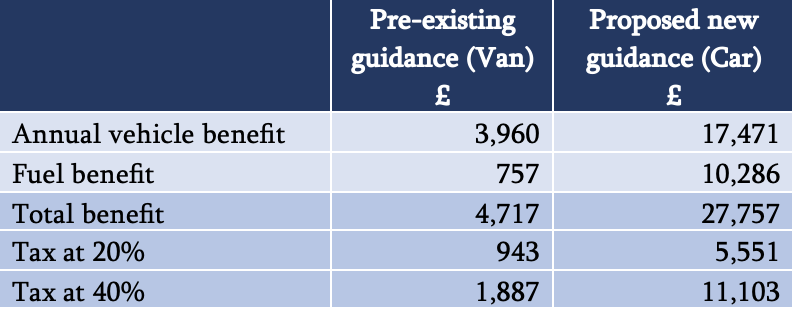

Although there are several options to choose from (such as the Ford Ranger, Nissan Navara, and Toyota Hilux to name just a few), if we take a middle of the range Ford Ranger with no optional extras as an example, this currently has a recommended on the road price of £39,350 plus VAT (i.e. £47,220 including VAT) and CO2 emissions of 230 grams per kilometre. The change in the guidance would have resulted in the following impact to an employee:

As can be seen by this example alone, if an employee was receiving use of this Ford Ranger as a benefit and also having all fuel paid for by the employer, the change in the guidance would have increased the employee’s tax liability by over £4,600 for a Basic Rate Taxpayer, if it somehow did not push them into higher rates thereby further exacerbating the tax impact, or over £9,200 for a Higer Rate Taxpayer.

It should also be noted that if the VAT inclusive list price of the double cab was higher than that used in the above example, this would have only further increased the disparity between the pre-existing guidance and the proposed new guidance.

Although this guidance has since been revoked, new legislation is due to be introduced in this regard to counteract the implications from the ruling in the Coca Cola tax case, at least to some extent. Whether this will formally legislate for the existing guidance in all regards remains to be seen but with the push towards “Greener” vehicles, it would not come as a surprise if this topic rears its head again.

By way of a reminder of the current rules with regards to double cab pick ups, please see our previous article which can be found here.

Article written by Helen Garrett