As part of the Chancellor’s Autumn Statement, a number of measures were announced aimed at supporting growth, one of which was the announcement that “full expensing” will be made permanent.

But what exactly is full expensing?

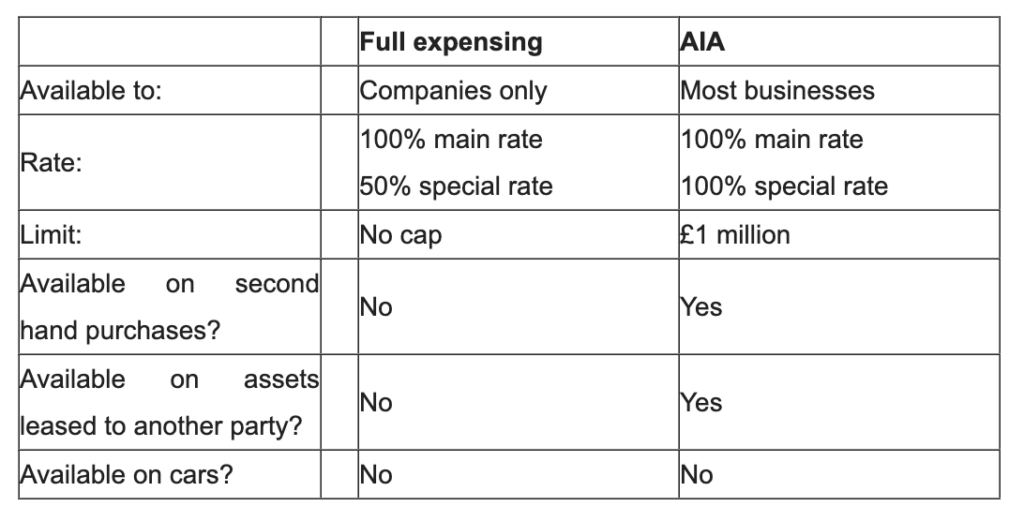

Full expensing is a form of capital allowance which was introduced in the 2023 Spring Budget that allows companies to claim a 100% tax deduction against taxable profits on new qualifying main rate plant and machinery in the year of purchase, or a 50% deduction for special rate assets.

This capital allowance offer originally had a sunset date of March 2026 when it was announced as part of the Spring Budget. This date has now been removed as part of the Autumn Budget making the available allowance permanent.

The main conditions of full expensing are that assets purchased:

- need to be unused (i.e. new) and not second hand; and

- must not have been purchased for the purpose of leasing to another party.

However, for most businesses, the Annual Investment Allowance (AIA) is still available to cover such expenditure, which also allows a 100% tax deduction against taxable profits (for both main rate plant and machinery and special rate assets), up to a maximum of £1 million in a 12-month period.

It should also be noted that full expensing is only available for companies, however the aforementioned AIA is available to unincorporated businesses and most partnerships.

Ultimately for a large number of companies who spend less than £1 million on qualifying assets each year, full expensing does not provide any further benefits due to the availability of the AIA, and in most instances, it will be beneficial to claim the AIA in priority to full expensing so that any balances on the main rate or special rate pools can be utilised against future disposals of assets, thereby accelerating relief.

Please contact you normal Wheelers contact for more information.

Article written by Jamie Burnham