Following numerous consultations and announcements over the last 18 months in relation to the effectiveness of the existing R&D schemes, both the R&D Expenditure Credit (“RDEC”) scheme for larger companies and smaller ones unable to claim under the SME scheme (possibly due to receiving grant funding) as well as the small and medium-sized enterprise (“SME”) scheme, there have been several changes announced, some of which have been implemented and others still on the cards.

Changes Announced

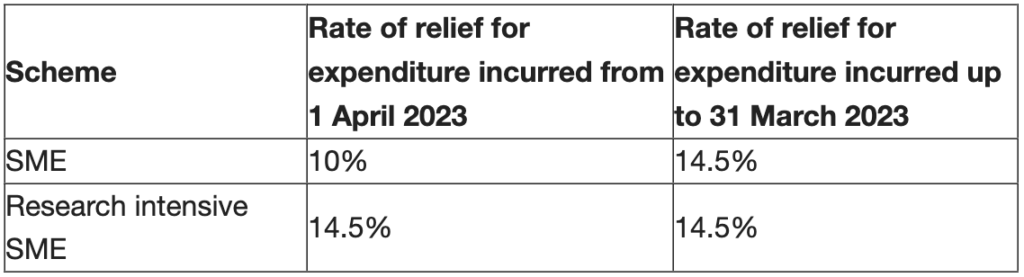

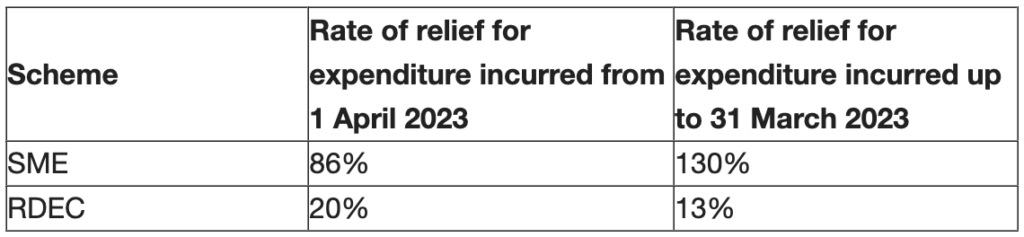

Rate of relief for qualifying R&D expenditure

As these rates of relief are based upon when expenditure is incurred, if a company has an accounting period that straddles 1 April 2023, any R&D qualifying expenditure incurred before 1 April 2023 will benefit at the former rates (SME scheme: 130% / RDEC scheme: 13%) whereas any expenditure incurred on or after 1 April 2023 will benefit from the rates effective from 1 April 2023 (SME scheme: 86% / RDEC scheme: 13%).

Repayment credit for loss making companies

Where an SME is loss making, or realises a loss by virtue of the R&D claim, the company may surrender the part of the loss arising as a result of incurring the qualifying R&D expenditure for a repayable tax credit.

The amount of this tax credit is as follows:

To be able to claim the tax credit, the company must still be a going concern until at least the time the tax credit repayment is made.

Since 1 April 2021, these R&D repayments are generally capped at £20,000 plus 300% of the company’s total PAYE and National Insurance Contributions liability for the period.

It should be noted that while the higher tax credit for research intensive SMEs has been announced to be effective from 1 April 2023, we are still awaiting legislation for this.

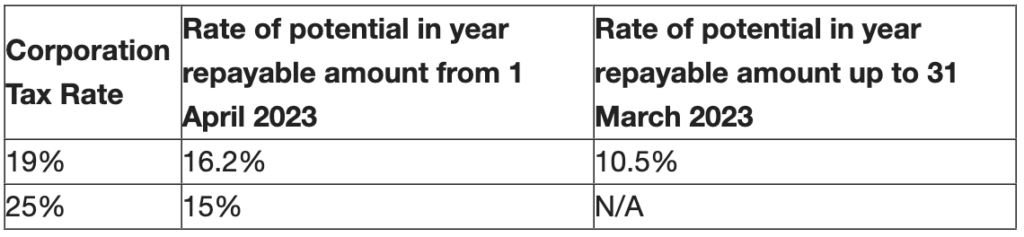

For companies claiming R&D relief under the RDEC scheme, should either a loss arise or the amount of the expenditure credit exceed any Corporation Tax liability arising, any amount repayable will be subject to the normal restrictions and offsets. However, by way of comparison for potential in year repayable amounts taking into account both the changes in the RDEC rate and in the rate of Corporation Tax:

Qualifying expenditure

Two new categories of qualifying expenditure have now been included with effect from 1 April 2023. These include:

- Data licences – Licences to access and use a collection of digital data.

- Cloud computing services – Includes the access and maintenance of remote data storage and hardware facilities as well as operating systems and software platforms.

Legislation for these changes is still being finalised but is expected to be effective for expenditure incurred from 1 April 2023.

Qualifying R&D

The scope of what activities qualify for R&D is due to be widened slightly with the inclusion of pure mathematics.

From an R&D perspective, and for those mathematicians among you, it is pleasing to see the government has at last acknowledged that mathematics is a fundamental part of science and should be held in the same regard, even if there will never be a Nobel Prize for mathematics.

Again, we are still awaiting changes in legislation to confirm this although it is expected that this will be effective from 1 April 2023.

Administration

There are two significant changes being made in relation to making claims for R&D:

- A requirement to notify HMRC that the company intends to claim R&D for accounting periods commencing on or after 1 April 2023.

Although there are exceptions where a company does not need to notify in advance that they are going to make an R&D claim, such as due to them having made an R&D claim within the period of 3 years preceding the end of the claim notification period, if a company does not notify HMRC within the claim notification period, no R&D claim will be available for the accounting period in question.

The claim notification period will run from the start of the accounting period concerned and finish 6 months after the end of the accounting period.

Companies will therefore need to consider and identify possible R&D claims much earlier as retrospective claims for earlier years will not be available moving forwards.

- For all R&D claims made on or after 1 August 2023, there will be a requirement for the company to submit an R&D additional information form prior to submitting the company’s Corporation Tax Return

For details of what information will be required, please see the following link:

https://www.gov.uk/guidance/submit-detailed-information-before-you-claim-research-and-development-rd-tax-relief

Although much of this information may be duplicated within an accompanying R&D report, in the majority of instances, it may still be advisable to submit a separate R&D report with the Corporation Tax Return as these will likely contain additional information in support of the claim, such as background on the company’s history, why the R&D is required, as well as details on key individuals involved in the R&D and their expertise.

Potential Future Changes

Expenditure on overseas workers and sub-contractors

Despite all the headlines and announcements at from the Autumn Statement, tucked away in the far reaches of the Spring Budget documentation, it has been confirmed that the proposed changes for restricting relief for expenditure on overseas workers and sub-contractors has now been delayed until 1 April 2024.

With the decrease in the rate of relief for qualifying R&D expenditure, this will be a welcome respite for some businesses conducting R&D involving overseas personnel.

Single R&D Scheme

Considering the consultation earlier in the year coupled with the subsequent decrease in the R&D relief available under the SME scheme and the increase in the rate of the RDEC as announced at the Spring Budget, it now seems more likely than ever that the government is looking to consolidate the existing R&D relief schemes into a single scheme in the not-too-distant future.

Although the consultation points towards a new scheme along the lines of the RDEC scheme, it remains to be seen what, if anything, is decided.

If you require further information in relation to R&D or wish to discuss a potential claim, please do not hesitate to contact us.